Saffron for Intermediaries has officially launched a new concept to brokers today. The Intermediar-ease concept has been developed on the back of communication with you, our broker partners, and will hold the mutual to account on service standards.

Thursday 5 May 2022 10:02 Press release

A recent survey conducted by Mobas on behalf of Saffron Building Society, identified that 68% of brokers had to complain to a lender for poor service in the last 12 months. Additionally, a further half admitted they had to complain to a lender due to the length of time to receive a decision for their client.

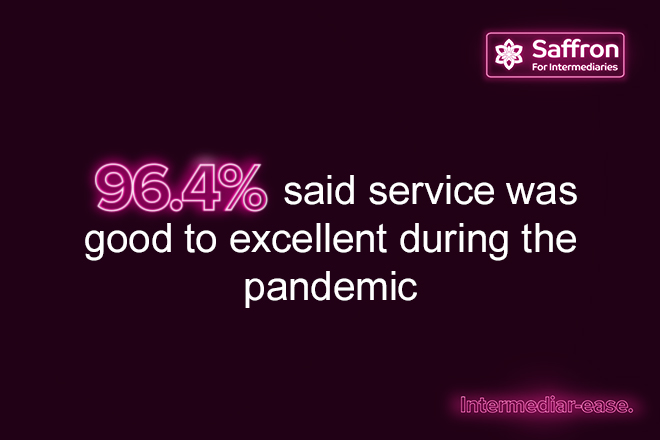

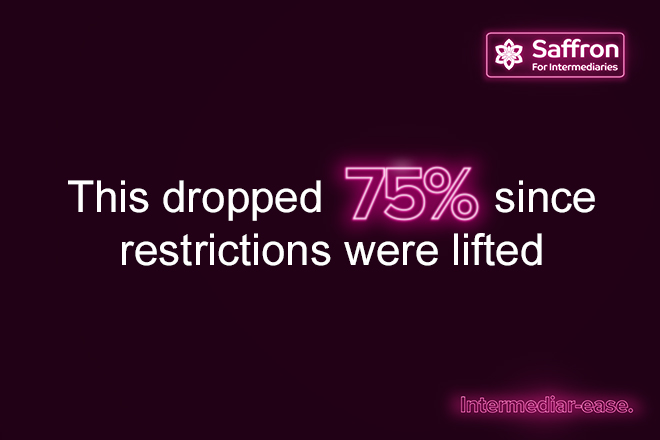

Brokers also admitted that service standards from lenders have dropped since the lifting of covid restrictions, with 96.4% stating the service was good to excellent during the pandemic. This dropped to 75% since restrictions were lifted.

Tony Hall, Head of Mortgage Sales is spearheading this initiative and comments: “The relationship with you, our brokers is paramount to the success of Saffron. When I joined the society in 2020, I realised we had work to do to build our reputation, improve our service and engage more effectively with brokers. The recent research shows that there is some dissatisfaction across the board, and this needs to be addressed. Following extensive strategic planning and insight, we can finally announce our new initiative, Intermediar-ease, which puts our service standards to account, opens communication channels and allows brokers to clearly identify the changes we have made, and those that will be made in the future.”

Since the pandemic, Saffron has made strides in the improvement of its service. The BDM team has grown from two full-time, and one part-time team members, to eleven. The society launched two new secure websites, with the intermediary site benefitting from new affordability calculators across the range of products, a live-chat function, and a news section to keep brokers informed of recent updates.

Saffron has also undertaken one of the largest criteria update across the product base in its 170+ year history. This created solutions that would help first-time buyers, self-employed and contractor clients who had been adversely impacted by the pandemic. Additionally, the lender continued to develop its education and entertainment platform, SFI LIVE, to engage directly with brokers.

“This is just the start.” Tony Hall comments. “With so many changes it is hard for brokers to keep up, which can mean missed opportunities for them and their clients. Equally, we know everyone is busy and may not always take the time to provide feedback to us. The ‘Intermediar-ease’ concept is a way to bring all of this together, and over time provide brokers with more avenues of communication, education around products and criteria, open access to underwriters and help us to continue to drive improvements in all areas of our service. I am proud of the changes that we have made, and our review scores continue to rise following a strong improvement in the last six months. The investment in people, products and our ongoing commitment to service is the driving force for me, and the BDM team. Whilst we know we can never be perfect; this initiative gives us a chance to reach for perfection and hold our hands up when we don’t get it right. In the coming weeks and months, we are holding ourselves to account like never before and ready to face the challenge.”

Intermediar-ease updates will feature prominently across the Saffron for Intermediaries social media channels, in regular email communications, will drive content on the website and will be the basis of education through the SFI LIVE webinar series.

Tony Hall will be answering your questions and accepting honest and open feedback alongside Intermediary Team Leader Deborah Tedder, on a one-off exclusive webinar on Wednesday, 18th May at 11am. Registration is open and completely free. Register here.